INTRODUCTION

“What I can do, you can do.” ~ Jesus Christ, who threw the moneychangers out of the Temple

The evolution of our currency systems has accelerated between the time I published my audio discussion for The State of Our Currencies in 2019 and the time that the research was complete for the written discussion in 2020.

It is impossible to understand the state of our currency without understanding that we live and transact in a transition time between two systems—amidst a global currency war.

The first system is the U.S. dollar, which has served as the global reserve currency since World War II. Over the last few decades, the syndicate responsible for the management of the U.S. dollar has extended its life and market share with a aggressive effort to extend laws and financial sanctions globally, while combing liberal lending with a series of financial shocks that often constitute entrapment. The result is that countries throughout the world have accelerated their efforts to create dollar independence.

Over the last year, numerous officials in the financial and political spheres have increasingly gone public regarding their belief that the effort by the Anglo-American alliance to institute a global unipolar model subsequent to the collapse of the Soviet Union has failed. They have also been open about their dissatisfaction with the U.S. dollar as reserve currency and their efforts to “de-dollarize.” These developments contributed to the perception of a weakening dollar during 2019 and early 2020.

The second system is “in the invention room” as we speak. Numerous parties throughout the developed and developing worlds, including members of the dollar syndicate, are attempting to bring up new digital transaction, payment, and settlement systems. The result is extensive debate and prototyping of new financial products and complex systems. The competition is fierce.

Whether associated with the decline and death of the old or the invention and birth of the new, the result is a complex, confusing landscape for even the most sophisticated financial observer. In other words, whether we are talking about global currency wars or high-tech financial prototyping, the state of our currency is defined by creative incoherence.

The important thing to understand in this transition period is that many members of the global leadership do not intend to bring up a new currency system for use by the general population. Instead, they intend to end the use of currency as we know it, as part of a radical reengineering of our existing laws, finances, and culture. Their goal is the end of individual sovereignty—managed with transaction systems that can operate without markets or currency in the classic sense and be integrated with other heretofore separate control systems.

In recent months, the global leadership has been more obvious about its development of new technology—including biowarfare and biometric control systems—to revolutionize planetary control systems. Consequently, the global multipolar tensions opposed to maintaining the current dollar system and the leadership’s psychopathic push to cancel currency systems for the general population are both relatively “out of the bag.” This makes it easier to have a frank discussion about the state of our currency.

My lifetime goal has been to create transparency and family and community wealth in a manner that will reduce environmental stress, organized crime, and war and reorient a world run through excessive secrecy and force. It is no surprise that I have encountered opposition in this effort, but not just from the leaders who profit from centralization. In fact, the majority of the effective opposition has come from a general population that embraces criminality—or at least its proceeds—and considers the efforts to prototype and develop greater central control as an opportunity to make money, achieve professional status, and find safety and convenience in the established order. The ease with which many embrace propaganda, digest mind control, and support genocide frightens those of us who see what is happening more clearly.

If you are reading this, you are among those who wish to preserve human sovereignty and freedom. I am deeply grateful for your intelligence and contributions. And you and I are not alone—far from it. The number of people appalled at where things are headed grows daily. Our opportunity to make a difference together—while the new system is still being prototyped and the factions compete—is significant. We are actors in the writing of history. We have a say now as to how it goes.

The state of our currency systems must be seen in this context—within a raging debate regarding the future of humanity. The debate is between those who hope to profit to an obscene degree from an end of human health and freedom, and those of us who wish to preserve a human society dedicated to freedom and prosperity for future generations.

Catherine Austin Fitts April 2020, Stavoren, The Netherlands

2nd Quarter 2019 Wrap Up: The State of Our Currencies

“So long as it is digital and centrally controlled, Mr. Global could not care less whether the new currency system is called dollar, peso, franc, gold, silver, or wampum beads.” ~ Catherine Austin Fitts, 2008

Table of Contents

I. Solari Report Resources

II. Introduction

III. Governance Structure: Who’s in Charge?

IV. The U.S. Dollar: Dominant and Dangerous

V. The Rise of China and Too Much Debt

VI. Space, the National Security State, Secrecy, and Privatization

VII. The IOT “Gold Rush,” Land and Real Estate, and the Final Mile

VIII. Financial Transhumanism and the Final Inch

IX. Currency, the Climate Change Op, and the Pandemic

X. Life in the Global Currency Invention Room

Bibliography

Chronology

Movies and Documentaries

Food for the Soul: The Moneylender

I. Solari Report Resources

My goal in The State of Our Currencies is to communicate where we are in the evolution of our currency system and describe the issues before us. As Solari Report subscribers have a diverse background, some may not be comfortable with basic terms and conditions regarding currencies. Wikipedia, Investopedia, and other readily available sources can give you general definitions. I encourage you to access them if you need a primer on currencies.

An analysis of global currencies touches on everything going on in our world. Global governance and resource use has an impact on all people, all places, and most institutions. It touches all natural resources, assets, and industries. It also deals with the fundamental laws and models we use to govern and manage our global economy and societies—not just the models we claim to use, but the models that we actually use. Consequently, a review of the state of our currencies necessarily is a high-level conversation, integrating much of our invisible and visible realities.

If you have digested the relevant content The Solari Report has published over the last decade, following such an overview will be relatively easy. If you are new to The Solari Report and your map of the world has not yet had the opportunity to consider or digest these aspects of where we are and where things are going, you may want to dive into our main website and well as our library to access a wealth of materials that will help you follow this discussion.

Recommended Solari Report resources include:

A. The State of Our Currencies audios. These are my overview discussions of this topic on The Solari Report in 2019 and 2020.

B. Discussions of the financial coup d’état that occurred in the United States from 1995 on, including $21 trillion missing from the U.S. government. These resources include interviews with Dr. Mark Skidmore and Rob Kirby, supported by a comprehensive collection of documentation at the Missing Money website (https://missingmoney.solari.com) and in the 2018 Annual Wrap Up: The Real Game of Missing Money. This also now includes the explosion of new fiscal and monetary stimulus begun in 2020 (see the Stimulus Tracker on the Solari website) and the likelihood of a “cut and run” following the issuance of FASAB Statement 56 by the Trump Administration in October 2018, which facilitates the transfer of government assets and operations to private hands on a non-transparent basis.

C. Annual and Quarterly Wrap Up themes from 2014 to date. Wrap Up themes help Solari Report subscribers understand long-lived trends underway. These include our coverage of the financial coup d’état and missing money; the shift from an industrial economy (Global 2.0) to a network economy (Global 3.0); the investment in a space economy and the transition to a multiplanetary civilization; the changes in the global food system; the rise of China and the resulting land empire between Asia and Europe; the globalization and growth of securitized equity, real estate, and debt markets; and the integration of new technology into centralized, technocratic control systems, including the use of the U.S. federal credit and financial coup d’état to centralize global wealth. These are all covered in our individual themes but also in my quarterly in-depth discussions with Dr. Joseph P. Farrell analyzing News Trends & Stories. All of the Wrap Up cover pages—which illustrate the Wrap Up’s primary theme—are linked from the bottom left on the home page.

D. Discussions about bringing transparency to the governance system. One of the defining features of life on our planet is that the real governance system is a secret. We don’t have the answers as to who is really in charge. We have asked a lot of UnAnswered Questions in Solari Report interviews with Dr. Joseph Farrell about the governance system and “breakaway civilization” and in discussions with Joseph for the News Trends & Stories section of our Wrap Ups. Additional Solari Reports on the black budget, underground bases, and “breakaway civilization” have also been invaluable.

E. Resources addressing “How could this be happening without me knowing?” One of the challenges involved in understanding the state of our currencies is coming to grip with the fact that our understanding of the world may not match what is actually going on. I am reminded of Bobby Kennedy’s comment after his brother was assassinated in Dallas. After he spent increasing time visiting poor neighborhoods in his campaign for the Senate and then the Presidency in 1968, he said: “I found out something that I never knew. I found out that my world was not the real world.” Valuable materials include our interviews on secrecy with Amy Benjamin, on 5G and technology with Jason Bawden-Smith, on understanding reality with Dr. Mark Skidmore, on control systems and propaganda with Jon Rappoport, as well as Solari Reports on mind control and entrainment. The latter also include related recommendations for excellent documentaries that inform about the nature and application of mind control technologies since the creation of the National Security State in 1947. Finally, many subscribers have found our Deep State Tactics 101 series helpful to understand the nuts and bolts of how this divergence between reality and official reality has been engineered.

I am not going to try to document or prove my thesis in The State of Our Currencies. This is one practitioner’s point of view at this moment in time. I hope my analysis inspires continuing discussion that helps the Solari network understand what is happening and what we can and should do about it. At the web presentation, I do provide a bibliography of recommended sources, a chronology of selected dates in the history of currencies, and helpful movies and videos.

If you find yourself having difficulty following The State of Our Currencies, I encourage you to post comments at Subscriber Input or at the related Solari Report commentaries, or send an email to askcatherine@solari.com for specific recommendations to help you supplement your investigation in a sequence that works best for you.

II. Introduction

“Let me issue and control a nation’s money and I care not who writes the laws.” ~ Mayer Amschel Rothschild

Discussions of monetary systems and policies often happen in a vacuum. However, given that our currency and financial systems are a subset of our governance system, it is not possible to understand them divorced from an understanding of our governance system—including who really runs things, what risks concern them, and what their goals are. As that information is secret, it is all too tempting to just ignore it.

Despite the uncertainties, it is imperative that we place the governance system question front and center. This is challenging in a period of rapid change. While some of us spent several decades discussing whether or not we should return to a gold standard, the United States experienced a financial coup d’état, including $21 trillion missing from U.S. government accounts and extraction of $29 trillion from the U.S. government to reimburse the banking system for massive mortgage and financial fraud. Now, the U.S. is embarked on $10-plus trillion (and counting) of monetary and fiscal stimulus in 2020. The accumulation of federal deficits and debt combined with retirement and pension obligations raise questions regarding the future existence of the United States, its laws, and government structure—and, with these, the U.S. dollar. We are approaching $60 trillion shifted out of the existing system, much of it into hidden hands, while liabilities are ballooning, with even more being moved onto taxpayers’ balance sheet.

These are all signs that a potential “cut and run” is underway. If not a “cut and run,” then certainly a radical reengineering of the U.S. governmental systems lies ahead. Indeed, it has been quietly happening behind the scenes for some time. Presumably, the radical reengineering is accelerating now that FASAB 56 has arranged complete freedom from financial reporting or laws.1

These actions have been supplemented by massive quantitative easing by the G7 central banks combined with engineering of interest rates down to near zero (and in some cases below zero), making it possible for sovereign governments to steadily increase their debt and deficits. This has resulted in a series of monetary and fiscal tsunamis that have managed to buy up control of almost everyone and everything, leaving us with a global society highly dependent on financial steroids, corruption, and criminal kickbacks—and excessively obedient to invisible centralized control.

This centralization was facilitated with a digital technology and telecommunications revolution. Since the late 1990s, a trillion-dollar infrastructure of cables, towers, and satellites to support this revolution has been rolled out at astonishing speeds. Moving from a handful of DARPA (Defense Advanced Research Projects Agency) scientists on the Internet communicating directly with each other, we now have five billion people with mobile devices. Approximately half of those are on smartphones. We are on our way to all eight billion people being able to communicate and transact directly, with the greatest growth coming in the emerging and frontier markets.

The suborbital platform around Earth is a critical element of the infrastructure for managing the necessary telecommunications on the ground.2 This makes our investment in space infrastructure a high priority. In essence, the control of the population and economy depends increasingly on the suborbital platform around us, just as it once depended on the global sea lanes. In an attempt to maintain dominance, including in the face of a rising Eurasia land empire between a growing China and a wealthy Europe, the United States has announced its intention to create a multiplanetary civilization while abrogating existing space treaties and converting space to a war-fighting domain.

The state and evolution of our currency systems has far more to do with technological change and our decision to become a multiplanetary civilization than with monetary policy. This makes it complicated. It is defined first and foremost by who is really in charge and where technology—much of which has been financed and developed in secrecy—will permit those in charge to take us.

III. Governance Structure: Who’s In Charge?

“Power corrupts, and absolute power corrupts absolutely.” ~ Lord Acton

“‘That’s not the way the world really works anymore,’ he continued. ‘We’re an empire now, and when we act, we create our own reality. And while you’re studying that reality—judiciously, as you will—we’ll act again, creating other new realities, which you can study too, and that’s how things will sort out. We’re history’s actors . . . and you, all of you, will be left to just study what we do.’” ~ Ron Suskind, The Price of Loyalty (Suskind’s book about Paul O’Neill’s experience as Secretary of Treasury in the Bush II Administration)

The most important unanswered question of our time is: “Who is in charge and what is the governance structure on Earth?”

I raise this question often. It is always in the list of Unanswered Questions in our quarterly and annual Wrap Ups. It invariably comes up when we talk about space investment and the space-based economy or when we discuss some of the more baffling issues related to our global financial system. These include the creation and growth of the black budget and related operations and technology development after 1947; the explosive growth of the National Security State after its assassination of U.S. Defense Secretary James Forrestal in 1949 and Forrestal’s protégé, President John F. Kennedy in 1963 and his brother and presidential candidate Senator Robert F. Kennedy in 1968 ; the financial coup d’état that began in the mid-1990s; and the near-miraculous longevity of the U.S. dollar as global reserve currency.

Any serious discussion of our currency system will bring this unanswered question front and center. When a discussion of how to improve or reinvent the currency system ensues, it does not take long to realize that the currency system is but one part of a larger financial system, which in turn is just one component of the governance system. You cannot tinker with one aspect without understanding and optimizing all aspects together.

An Accurate Diagnosis

My father was a surgeon. Surgery was a topic he liked to discuss at the dinner table. As he was a brilliant man and passionate about his work, these were fascinating discussions. One of the things that became clear to me as a child was the importance of a sound diagnosis before cutting into a man’s or woman’s living body.

My father would sometimes spend hours and days ruminating on what was wrong with one of his patients before he would proceed with surgery. All the different parts of the body were connected. He did not want to affect one without understanding what it might do to the other parts. He wanted to make sure he solved the problem, rather than solving a symptom and making the problem worse. His colleagues said that his genius stemmed from remarkable intuition and powers of diagnosis. I saw it as a form of integrity.

I think of the surgery metaphor a lot during discussions of our currency system.

I am often told that our currency system does not work. However, until recently, it worked just fine for the central banks who operated it and the central bank members and owners. The currency system has been used to centralize political and economic control. If you look at this effort since the mid-1990s—the period that launched what I call the “financial coup d’état”—the currency system has engineered a remarkable centralization of wealth. While our existing nation-states have been levered up with trillions in debt, a great deal of that credit, money, or assets has been transferred out to private hands—with liabilities retained or moved back into the nation-states. It is the greatest “piratization” of all time. In short, our currency system has been quite successful for the beneficiaries. It also worked for some of the American middle and upper classes who preferred to benefit from the kickbacks and subsidy it provided, rather than “turn the red button green.”3

Centralization has generated significant frustration on the part of those whose power and wealth has been skimmed, diminished, or destroyed. This includes the BRICS nations, the growing economies in Asia, and the emerging markets, who resent the costs, restrictions, and liabilities of working through the U.S. dollar trade and settlement systems. It also includes communities and citizens in the United States and throughout the world who are experiencing significant debasement of their currency holdings and pension fund assets, are struggling with corrupt governments, and find themselves responsible for exploding sovereign debt.

These groups often say that the currency system is not working for them and that we need a new currency system. What they mean is that the existing governance system is not working for them, and they do not want their transaction capability to be unnecessarily controlled or restricted through the currency mechanism maintained by the syndicate that controls the U.S. dollar. Here is another way to look at it: One group is skimming, and another group is being skimmed. The group being skimmed is tackling the hard, inconvenient challenge of building workarounds and alternatives. Meanwhile, the skimming group is pushing back.

Indeed, there is no reason that the U.S. dollar system could not be reformed to work productively as a liquid global currency. However, that would mean that it could not be used—as it increasingly is—as a political tool to control or extract economic value. The reason that we hear very little discussion of reforming the dollar system is that those who control it would rather use new technology to move to even greater levels of control. Those who don’t control the system would rather get out from under it or compete with superior control systems. No one believes that cooperation and alignment is a possible way forward.

What currency systems need to work is trust. Unfortunately, trust is leaving global currency bubbles like air leaving a ballon.

This issue of governance systems versus currency systems is essential to consider when someone proposes changes to the currency system that represent an attempt to solve the symptom rather than the problem. The dangers of doing surgery without a proper diagnosis are significant. Let’s look at some examples.

Example: A Gold Standard

The financial world is full of a wonderful group of highly intelligent, passionate people who extol the virtues of the Austrian School of Economics and sound money, including proposals for returning to a gold standard.

From the Merriam-Webster Dictionary:

Austrian School: “The proponents of and adherents to the economic theories developed by Karl Menger (1840–1921), Friedrich von Wieser (1851–1926), and Eugen Böhm-Bawerk (1851–1914) of Vienna, Austria, who originated a subjective theory of value that utilizes the doctrine of marginal utility rather than the Ricardian labor theory of value and who formulated a productivity theory of interest and capital that emphasizes the importance of the time element in production.”

Sound money: “Money not liable to sudden appreciation or depreciation in value.”

Stable money: “A currency based on or redeemable in gold.”

Gold standard: “A monetary standard under which the basic unit of currency is defined by a stated quantity of gold and which is usually characterized by the coinage and circulation of gold, unrestricted convertibility of other money into gold, and the free export and import of gold for settling of international obligations.”

Much of what the Austrian School says makes sense, until you start to consider tinkering with the actual currency system. Let’s demonstrate the problem.

A simple estimate of the monies that have been transferred out of the U.S. pension funds and U.S. government in the financial coup d’état since fiscal 1998 is approximately $60 trillion. This consists of $21 trillion missing from the Treasury through DOD and HUD between fiscal 1998-2015, $24-$29 trillion from the 2009-2012 bailouts, plus what is now approaching $10-plus trillion on various stimulus packages in 2020. It may well be more by the time you read this. As of this writing in late April, the U.S. deficit for fiscal 2020 (which ends on September 30, 2000) is estimated to reach $5 trillon.

If we add more for quantitative easing policies by the Federal Reserve since the bailouts, we could get much higher. If we were to throw in what has been happening at the European Central Bank (ECB), the Bank of Japan (BOJ), and other governments and central banks, we could get to a higher number still.

Suffice it to say that at least $60 trillion has been transferred out of the G7 governments, including that portion financed by the sale of sovereign bonds to our pension and retirement funds and trusts. This theft of assets was facilitated by a central bank and its private members with the power to create fiat currency. The resulting monetary inflation and debasement of our currency has been significant and is likely to be more significant in the future.

All of this is, of course, quite true. Now that a small group has gotten together and stolen $60 trillion and a great deal of the gold on the planet, the solution put forth by the well-intentioned—such as those who adhere to Austrian School economics—is to institute a sound money policy, with a return to a gold standard as one proposal. Are we really going to institute a sound money policy that will protect the small group’s assets, dramatically increase the value and strategic power of their gold holdings, and diminish our own access to capital going forward? This will simply consolidate and further enhance the power of the people who engineered the theft of our capital through the coup d’état, while dramatically diminishing our ability to recreate or replace our lost wealth. In other words, a policy that focuses on sound money rather than governance will both consolidate and significantly increase the success of the financial coup.

Example: A Debt Jubilee

Proposals for a debt jubilee that are not specific about who and what will benefit have similar shortcomings. What is the point of further enhancing the power of the coup leadership at our own expense? Let’s take a look.

A small Group A steals $60 trillion through governments and central banks. They use the money to buy up all the real assets—gold, real estate, weapons, and spaceships. To finance this, they sell most government bonds to Group B’s pension funds and retirement assets. Then they announce that to give relief to Group B, “we need a debt jubilee.” That sounds great, right? With the jubilee, all of Group B’s pension funds, retirement assets, and even some insurance holdings are wiped out since they were stuffed full of the debt used by Group A to finance their financial coup.

In other words, Group A just doubled down on their winnings by tricking the body politic into a debt jubilee. But the game is not over yet because then Group A comes in for the kill and buys all of Group B’s assets at fire sale prices—using the money stolen from Group B!

Cui Bono? Who Benefits?

Here is the bottom line: Whether adopting sound money policies or proceeding with a debt jubilee are good ideas depends on how they are designed—the devil is in the details.

In the game of economic warfare, please always ask “who.” Who’s doing this? Cui bono? Who benefits? Who wins? Who loses?

When we go into the invention room to reinvent the currency, exactly who will be the winner and who will be the loser? Do you want to redo the currency system if it makes the people who used the existing currency to repeatedly pump and dump you and engineer a financial coup d’état more powerful? Do you want to engineer a system in which “crime pays”?

This is why I keep asking the question, “Where is the $21 trillion of missing money?” Unless the money that was stolen in the financial coup d’état (and the money being stolen through the new stimulus measures) is on the table, I have little desire to go into the financial surgical suite with Mr. Global (my nickname for “the committee that runs planetary governance”). Better to first bring transparency to the governance system. Who is really running things? What are the risks they are managing? Where do they want to go, and why?

My point is that we cannot have an intelligent discussion regarding our currency without understanding how it fits into our existing governance structure.

Our challenge is that everything we need to know is cloaked in a veil of secrecy—from government finances to central bank ownership and operations, to the fundamental nature, leadership, and process of global governance. This secrecy—and the force that makes it go—has been a major contributor to the corruption of our financial system and society. Unless and until we are prepared to do something about it, changes in the currency system will be harmful to each and every one of us.

When people ask me to propose a design of a new currency system, my response is simple. Step one: Turn on the lights. Stop contemplating surgery without a proper diagnosis. Supporting changes to our currency when we are ignorant of the global political chessboard is a recipe for political and financial suicide.

IV. The U.S. Dollar: Dominant and Dangerous

“The United States accounts for 23% of global GDP and 12% of merchandise trade. Yet about 60% of the world’s output, and a similar share of the planet’s people, lie within a de facto dollar zone, in which currencies are pegged to the dollar or move in some sympathy with it. American firms’ share of the stock of international corporate investment has fallen from 39% in 1999 to 24% today. But Wall Street sets the rhythm of markets globally more than it ever did. American fund managers run 55% of the world’s assets under management, up from 44% a decade ago. The widening gap between America’s economic and financial power creates problems for other countries in the dollar zone and beyond. That is because the costs of dollar dominance are starting to outweigh the benefits.” ~ “Dominant and Dangerous: A Special Report on the Dollar’s Role in the World Economy,” The Economist, 2015

The United States became the world’s largest economy in the 1870s, but it took another five decades for the U.S. dollar to make serious inroads to compete with the British pound sterling as the world’s reserve currency. From World War I through the creation of the Bretton Woods system in 1944—a year before the end of World War II—the pound sterling and the U.S. dollar shared a reserve currency duopoly. After Bretton Woods, the U.S. dollar emerged as the global reserve currency.

The U.S. dollar has remained the global reserve currency ever since. Although the launch of the euro in 1999 drew meaningful market share from the dollar, the countries in the European Union still depend on the U.S. military and NATO for their defense. The Japanese yen has a small market share of global reserves and trade, but Japan also depends on the U.S. for its national security umbrella. The pound sterling continues to function modestly as an international currency. These four currencies were the basis of the International Monetary Fund’s (IMF’s) Special Drawing Rights (SDR) until the Chinese reminbi was added in October 2016.

The process by which the dollar rose to its current status is instructive for understanding the characteristics of a global reserve currency. Factors at play include the size of the economy, central banking, market liquidity, the role of the military, and the “financial bazooka.”

Size of the Economy

The size of the issuer’s economy is important—but not as important as you might think. It took 70 years after the U.S. became the largest economy in the world for its currency to dominate.

Central Bank

The U.S. dollar did not begin to share reserve currency status until it had a central bank that was a central management and transaction point for global central banks and financial institutions. This helps to explain the bitter war to create the U.S. Federal Reserve in 1913. Those who conspired to do so understood the extraordinary benefits of shifting the dollar into a reserve currency status. I suspect this also helps explain the current push for the equivalent of either a global central bank or transitioning the Federal Reserve to function as a global bank. Many of the current tensions of operating the Federal Reserve are between providing global liquidity versus serving the domestic economy well.

Market Liquidity

For the dollar to serve as a global reserve currency, U.S. banks and Wall Street had to be prepared to provide liquidity and lending in both New York and in financial capitals around the world. Building out the necessary relationships and transaction mechanisms was no small feat. It took New York many decades—and a World War—to build out sufficient networks to supplant the City of London in the reserve currency role.

Role of the Military

The global financial system operates on a central banking-warfare model. The central banks and their member banks print or digitize fiat currency out of thin air, and the military makes sure that people and countries exchange it for valuable natural resources and labor. The fundamental economics depend on the benefits (cheap labor and natural resources) exceeding the cost of the military and intelligence capacity and financial infrastructure that makes the system go.

Traditionally, Ango-American dominance—first the pound sterling and then the dollar—depended on naval power and control of the global sea lanes. I remember reading that the dollar’s rise began with the U.S. Navy asserting dominance of the sea lanes in the Caribbean. That’s an important historical footnote relevant to the current effort by the Chinese to advance its control over the sea lanes in the South China Sea.

Increasingly, dominance in the suborbital platform and space is required as GIS and other satellite capacity become critical components of the infrastructure needed for global communications and operations. The high cost of maintaining dominance in both space and on the high seas—especially after very expensive military commitments in the Middle East—is contributing to the United States’ demands that NATO and Asian allies contribute more to defense. The importance of space also explains why both the EU and China are building global satellite capacity independent of the Americans. Russia has long been and continues to be a leader in space and satellite technology.

The Chinese are remarkably open regarding their long-term plans. If you look at their published plans for the military and the buildout of their currency systems globally, their military investments are clearly designed to support significant increases in global currency liquidity.

Financial Bazooka

One of the key components of the dollar’s leadership has been its managers’ ability to engage in financial warfare. I call the combined machinery in place to do this a “financial bazooka.”

One of the reasons the dollar did not replace the pound sterling until after World War II is that it took a while for New York and Washington to assemble a financial bazooka that could match that of the City of London and handle the treacheries of trading and maintaining liquidity in the global system. Major factors contributing to the financial bazooka were the creation in 1934 of a long-term mortgage market through the passage of the National Housing Act—which created the Federal Housing Administration (FHA)—and the Gold Reserve Act that created the Exchange Stabilization Fund (ESF).

The real juggernaut, however, came at the end of World War II with the creation of a hidden system of finance that allowed U.S. intelligence agencies to function as the most powerful bank in the world—free from laws and taxes—and the provisions for the U.S. black budget that came from the National Security Act of 1947 and the Central Intelligence Agency Act of 1949. This system has now been operating for many decades, enhanced domestically by the power of the National Security Agency (NSA) and internationally by the Five Eyes intelligence and surveillance systems. It is hard to imagine how another country could launch a financial bazooka that could match this one, although it helps to explain why the U.S. battle with Huawei is at the heart of the matter.

The United States led a new round of globalization after the passage of the Uruguay Round of GATT and the creation in 1995 of the World Trade Organization (WTO). Sir James Goldsmith described this process in his interview with Charlie Rose at the end of 1994. If you have not watched that video, I recommend it as a basis for understanding the last three decades of globalization and the reason many are pushing to slow it down or reverse it.4

This three-decade wave of globalization was accompanied by a “strong dollar policy.” A rising dollar, combined with a variety of actions to lower the value of currencies and assets in the emerging markets, facilitated a wave of “sell high, buy low” in the global sweepstakes. The events of 9/11 then followed, justifying the shift of American military forces into the Middle East and the global “war on terror.” The plan announced shortly after 9/11 was regime change in seven countries in five years.

One had the distinct impression that the seven-countries-in-five-years plan represented a currency war to prevent oil from being traded in euros, halt rising plans to use gold, and impede new arrangements to facilitate trade and equity in the emerging markets outside of New York and the City of London. In addition, the plan appeared to be an attempt to force all nations into the Bank of International Settlements (BIS) central banking system, with central banks that could be owned and directed privately. These were steps toward “one-world government.5”

The plan did not work. While its backers certainly got wealthier, the U.S. Army and American policy got bogged down in the Middle East. Secretary of the Treasury Paul O’Neill and senior economic advisor Dr. Larry Lindsey, who both presented an obstacle to starting the Iraq War, left the Bush administration in December 2002. Lindsey was replaced by Stephen Friedman6 after a dispute over the projected cost of the Iraq war.7 Lindsey estimated the cost could reach $200 billion, while Secretary of Defense Rumsfeld estimated the cost at less than $50 billion. The actual cost is now approaching $6 trillion, and even so, a few countries remain with central banks that are not privately owned or are not in the central bank system. Perhaps our current state of biowarfare is designed to finally get the job done.

The financial crisis that began in 2008 strengthened the dollar position. Global investors sought significant amounts of safe-haven securities, and liberal monetary policies provided significant monies to fund dollar-denominated loans and capital throughout Asia and the emerging markets. The subsequent euro crisis and European bank losses resulting from sovereign debt issued by the Southern European countries flatlined further growth in the euro share of reserve currency holdings. The dollar remained—as The Economist described in 2015 —“dominant and dangerous.”

As the world recovered from the shock of the financial crisis, there was a growing push outside the Anglo-American alliance to find ways of reducing dependency on the dollar as the dominant global reserve currency. The 2008 financial crisis had not been the first such shock. Earlier episodes included the Asian financial crisis in 1997 and numerous other examples of “shock doctrine” during this wave of globalization. However, the extent of the financial fraud and corruption exposed during the 2008 crisis created a new urgency and spirit of collaboration to lessen dollar dependency.

The syndicate that runs the U.S. dollar, however, did not sit still. The financial crisis was followed by an aggressive extension of U.S. legal and regulatory authority throughout the global financial and banking systems, along with a new regime of U.S. financial sanctions8 and aggressive competition for offshore haven funds. U.S. enforcement has used the dollar system to assert global jurisdiction and, through that jurisdiction, to engage in economic warfare to gain control of companies and assets globally.

Stories of “Sheriff of Nottingham” type enforcement actions and prosecutorial misconduct against both domestic and foreign business executives and globally against foreign companies have badly debased the notion of the American “rule of law,” redefining it as the “rule of racket.”9 Increasingly, one wonders if the Department of Justice exists to shake down small domestic companies and foreign companies to expand markets and profits for American monopolies. I am reminded of one of my investment colleagues who referred to the Patriot Act as “The Control and Concentration of Cash Flow Act.”

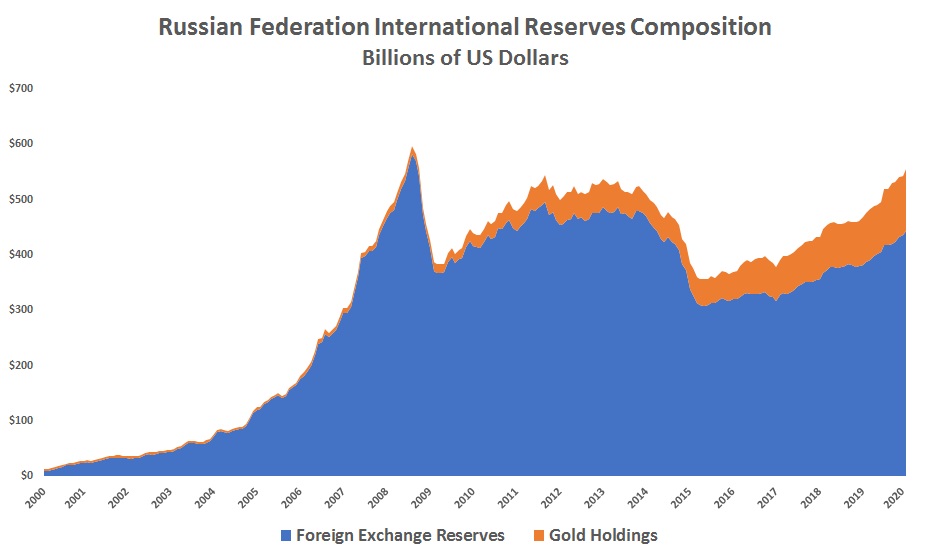

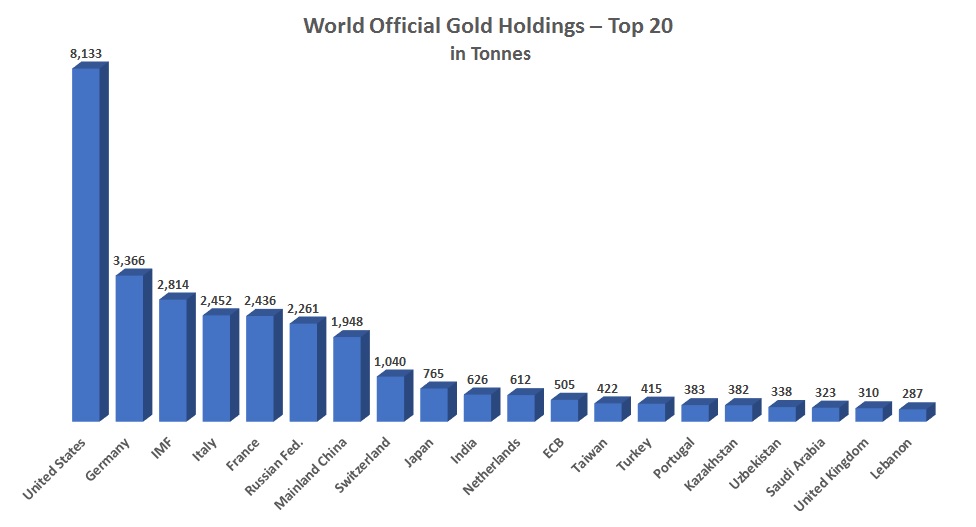

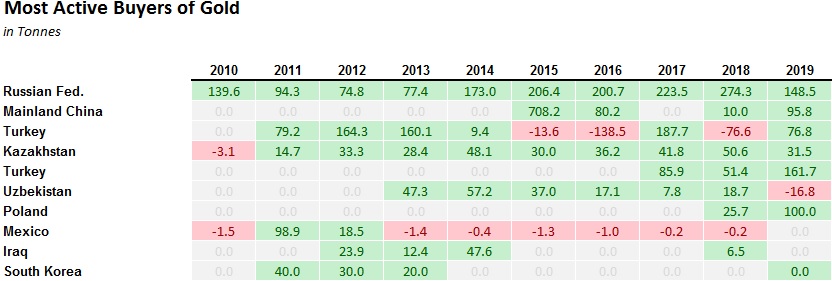

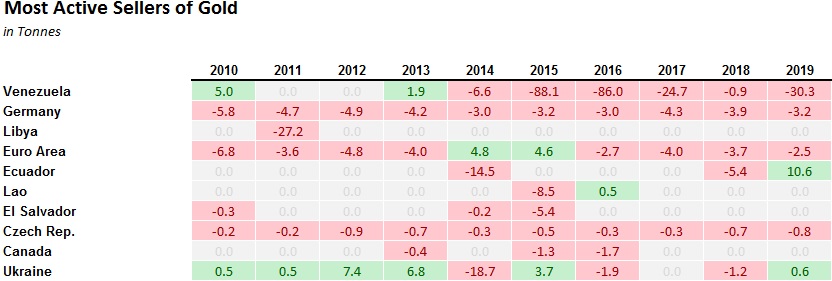

The BRIC nations—Brazil, Russia, India, and China (with South Africa joining in 2010 to make it BRICS)—as well as the Association of Southeast Asian Nations (ASEAN) went to work on creating swap capacity between central banks. New lending banks were created to reduce dependency on the IMF and dollar-denominated lending. Central banks began developing cryptocurrencies. Gold reserves rose in Russia and in central banks along the Silk Road, often at the expense of the dollar market share. In response to a series of sanctions, Russia shifted its reserves out of U.S. dollars, increasing euros and yen in addition to gold.

Source: Bank of Russia

Source: World Gold Council

Data from International Monetary Fund’s International Financial Statistics, as of January 2020

Source: World Gold Council

Data from International Monetary Fund’s International Financial Statistics, as of January 2020

Source: World Gold Council

Data from International Monetary Fund’s International Financial Statistics, as of January 2020

Meanwhile, China got to work establishing multiple centers globally to create liquidity for the renminbi in financial capitals around the world and was finally able to persuade the IMF in 2015 to include the renminbi in the SDR in 2016. China and Russia also significantly increased their financial and economic cooperation. Russia’s central bank opened its first overseas office in Beijing in 2017, creating an institutional capacity to bypass the dollar and phase in a gold-backed standard of trade.

After President Trump was inaugurated in early 2017, major changes unfolded, with efforts to repatriate capital to the U.S., the U.S. cancellation of the Paris and Iran agreements, and a U.S. Congress intent on Russophobia. Russia proceeded to launch an alternative to the SWIFT payment system, and Europe created the INSTEX system to avoid sanctions on trade with Iran while working on an independent credit card system.

In late 2018, in response to pressure regarding the inability of the Department of Defense to complete an audit in the midst of pressure regarding the $21 trillion missing from DOD and HUD, the Trump Administration and Congress adopted a statement by the Federal Accounting Standards Advisory Board (FASAB) that they claimed permitted them to maintain secret books. The Solari Report has provided extensive coverage of what this means to the U.S. federal credit and the credit of U.S. Treasuries and related mortgage, municipal, and corporate securities. In short, the U.S. government now takes the position that it is free to operate outside of the laws related to government or securities financial disclosure and internal financial controls.

The Missing Money website

https://missingmoney.solari.com/FASAB Statement 56: Understanding New Government Financial Accounting Loopholes

https://constitution.solari.com/fasab-statement-56-understanding-new-government-financial-accounting-loopholes/Caveat Emptor: Why Investors Need to Do Due Diligence on U.S. Treasury and Related Securities

https://home.solari.com/caveat-emptor-why-investors-need-to-do-due-diligence-on-u-s-treasury-and-related-securities/

While there are days when it feels like we are all pretending that this did not happen, no doubt the continued breakdown in U.S. financial practices contributed to the pivot in Fed policies to reverse course on raising interest rates and intervene in the repo markets starting in the fall of 2019 as well as to increasingly public warnings by both government and central bank officials.

Mark Carney, governor of the Bank of England, announced the movement to a multipolar world at a meeting of central bankers in Jackson Hole, Wyoming in August 2019, saying, “The world’s reliance on the U.S. dollar won’t hold and needs to be replaced by a new international monetary and financial system based on many more global currencies.”

In September, French President Emmanuel Macron declared the unipolar empire a failure. Mike Smith summarized his comments as follows:

“We are probably in the process of experiencing the end of Western hegemony over the world. We were used to an international order that had been based on Western hegemony since the 18th century – French in the 18th century, inspired by the Enlightenment;Britishin the 19th century thanks to the Industrial Revolution, and American in the 20th century thanks to two major conflicts and the economic and political domination of that power. Things change. They have been deeply affected by the mistakes made by Westerners in certain crises, by American decisions over the last several years which did not start with this Administration, but have led us to re-examine certain involvements in conflicts in the Middle East and elsewhere, and to rethink fundamental diplomatic and military strategy and on occasion elements of solidarity which we thought were forever inalienable, even though we had developed them together during periods of geopolitical significance, which have however now changed. And it is also the emergence of new powers whose impact we have probably underestimated for far too long.

China, first and foremost, as well as Russia’s strategy that has, let’s face it, been pursued with greater success over the last few years. India and emerging new economies that are also becoming not just economic but political powers and which consider themselves genuine civilization states and have not only disrupted our international order, but assumed a key role in the economic order.”

Finally, in late 2019, the BRICS nations met to discuss the creation of a joint cryptocurrency, and Putin announced that the U.S. dollar was likely to collapse soon:

“The dollar enjoyed great trust around the world. It was almost the only universal currency in the world. For some reason, the U.S. began to use dollar settlements as a tool for political struggle, imposing restrictions on the use of the dollar. They began to bite the hand that feeds them. They’ll collapse soon. Many countries in the world began turning away from using the dollar as a reserve currency. They restrict Iran in its dollar settlements. They impose some restrictions on Russia and other countries. This undermines confidence in the dollar. Isn’t it clear? They are destroying the dollar with their own hands.”

~ Vladimir Putin, November 2019

[ADD VIDEO IN WEB PRESENTATION: https://twitter.com/Ben__Rickert/status/1195282924624465927]

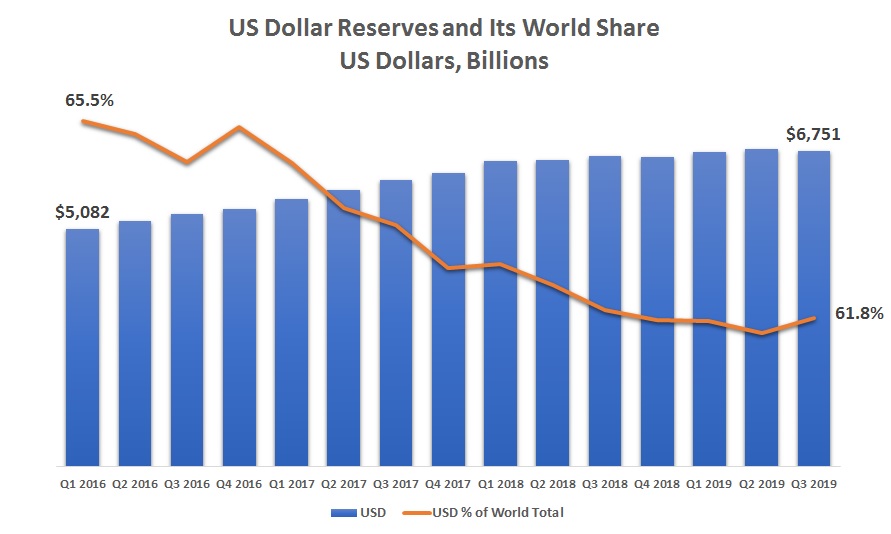

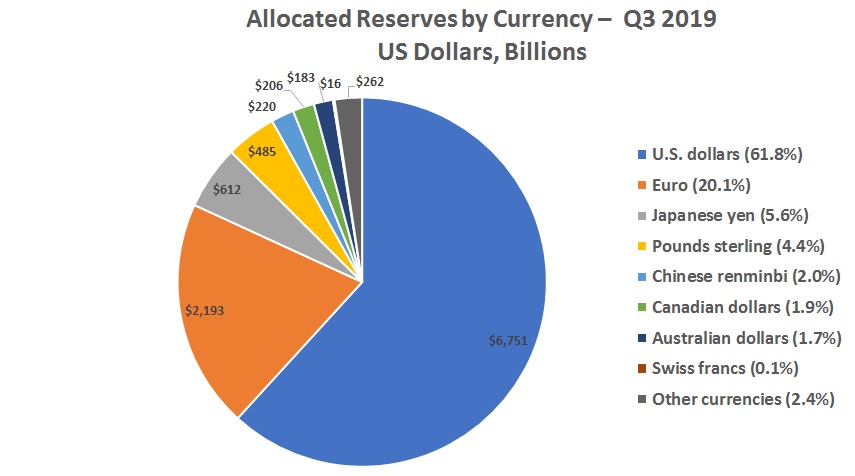

Putin’s comments attracted more than a little attention given that the dollar market share, while falling, remained quite strong—both as reserve currency and as share of trade.

Source: International Monetary Fund

Source: International Monetary Fund

Kimberly Amadeo, president of WorldMoneyWatch, summed up the continued strength of the dollar market share nicely in August 2019 in “Why the US Dollar Is the Global Currency”:

As of 2018, the U.S. had $1,671 billion in circulation. As much as half that value is estimated to be in circulation abroad. Many of these bills are in the former Soviet Union countries and in Latin America. They are often used as hard currency in day-to-day transactions.

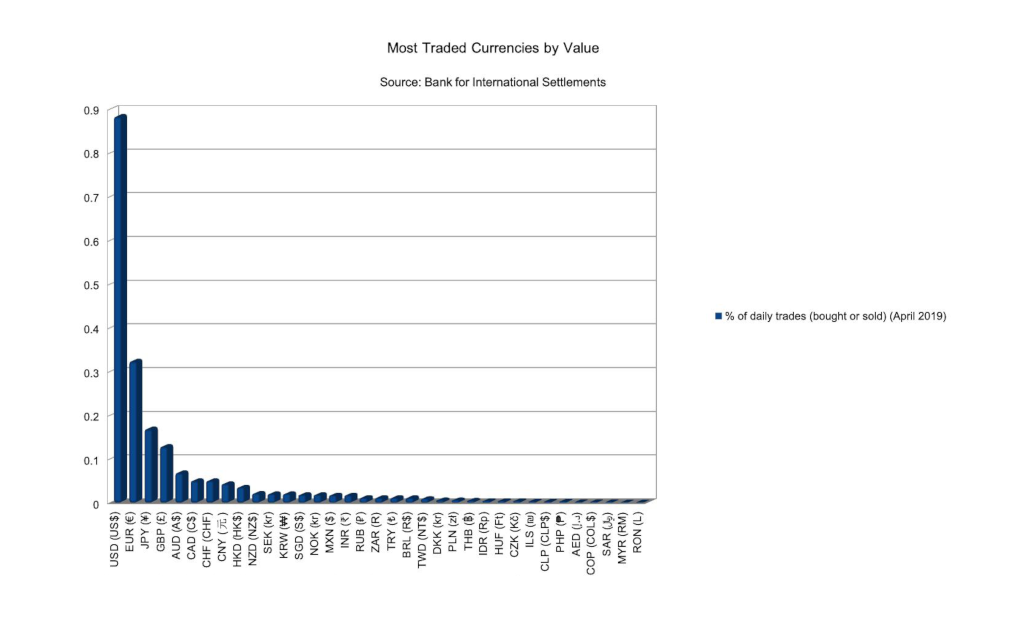

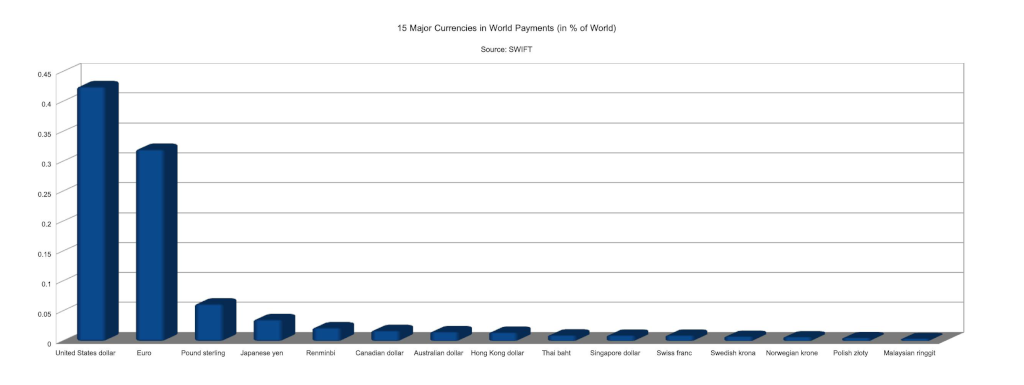

In the foreign exchange market, the dollar rules. Around 90% of forex trading involves the U.S. dollar. The dollar is just one of the world’s 185 currencies according to the International Standards Organization List, but most of these currencies are only used inside their own countries.

Theoretically, any one of them could replace the dollar as the world’s currency, but they won’t because they aren’t as widely traded.

Almost 40% of the world’s debt is issued in dollars. As a result, foreign banks need a lot of dollars to conduct business. This became evident during the 2008 financial crisis. Non-American banks had $27 trillion in international liabilities denominated in foreign currencies. Of that, $18 trillion was in U.S. dollars. As a result, the U.S. Federal Reserve had to increase its dollar swap line. That was the only way to keep the world’s banks from running out of dollars.

The financial crisis made the dollar even more widely used. In 2018, the banks of Germany, France, and Great Britain held more liabilities denominated in dollars than in their own currencies.”

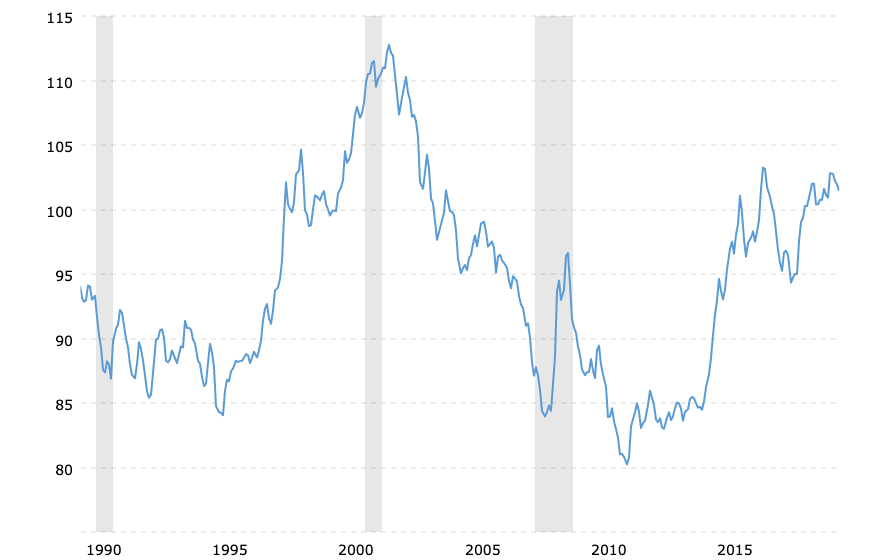

In the meantime, the U.S. Dollar Index has remained strong following its sharp rise in 2014. That was a year in which I had more than a few bruising fights with financial commentators and colleagues. Early that summer, they insisted that the dollar was going to collapse. I insisted it was going to rise and rise strongly. I was right, but being right was not very popular.

US Dollar Index 30-Year

Source – Macrotrends

I have a framed $1 bill from Greg Hunter of USA Watchdog in my office—payment in full for my bet that the dollar would not collapse that year. The refusal of many to look deeply under the carpet regarding why they had been wrong—to do a proper “lessons learned”—was a major line in the sand for me. I rearranged my time to only collaborate with those who were willing to deal with reality, including the related unanswered questions.

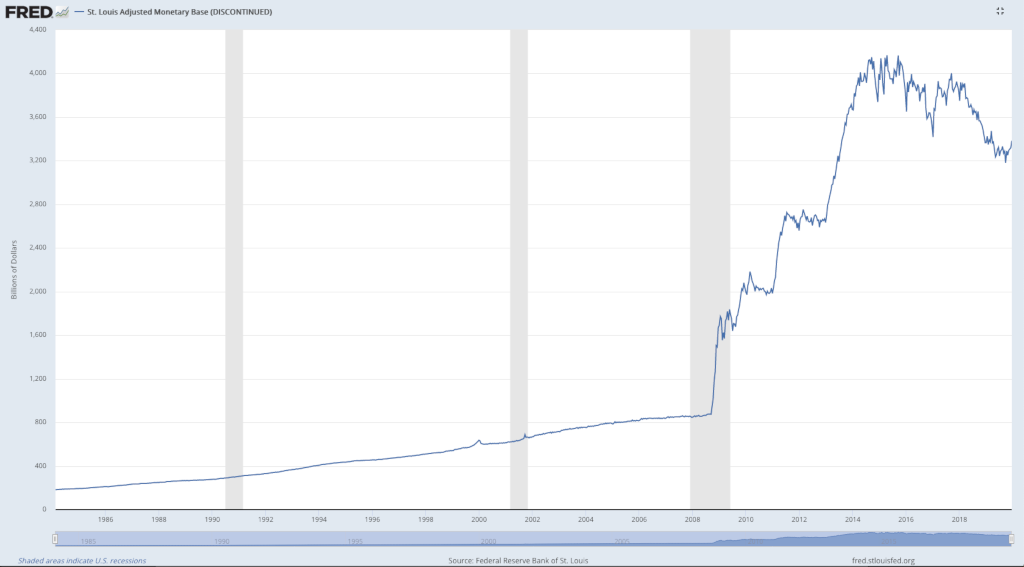

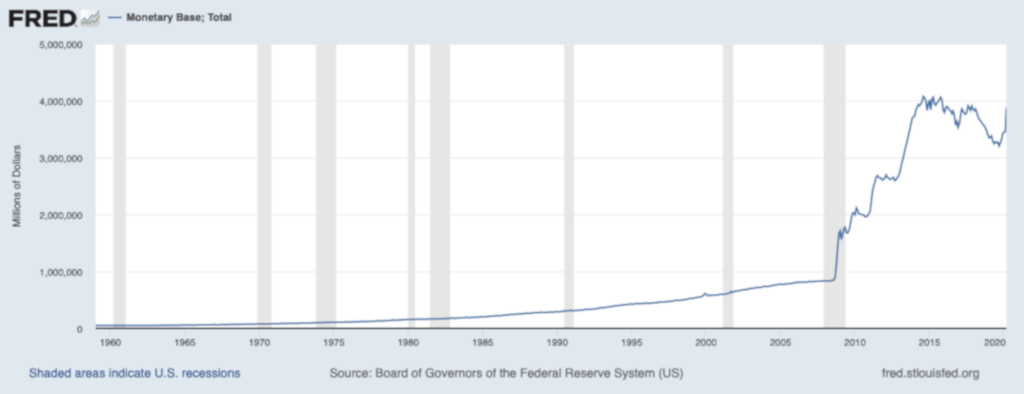

By the end of 2019, however, the dollar and the global financial system were under stress. U.S. federal debt was rising, with greater deficits as a result of mounting military expenditures. A new tax cut was expected to raise deficits and debt even more. As a result of the Fed’s pivot, the U.S. monetary base was rising quickly, as was the domestic cost of labor and household goods.

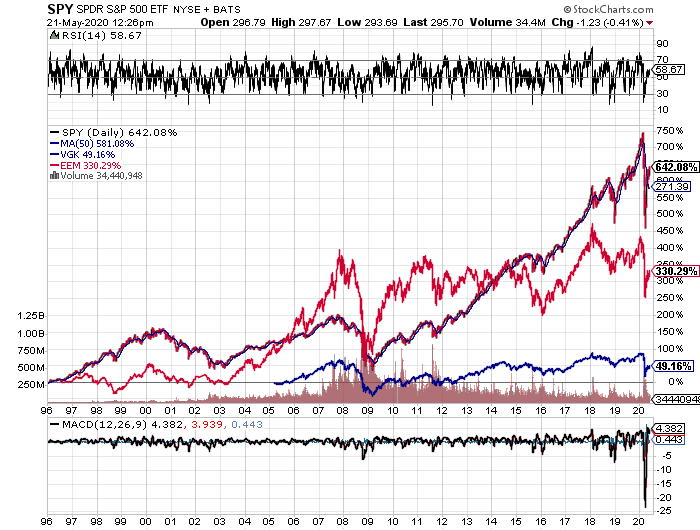

Every investment advisor I spoke with in December of 2019 said that the U.S. stock market had reached its maturity and that the time had come to diversify into European and emerging market equities.

As Putin’s comments in November 2019 indicated, the winds of war were brewing. Some of the most prescient comments came from a haunting interview that Herman Gref, President and CEO of the largest Russian bank Sberbank, gave to TASS10:

“An explosion will be imminent, unless the international and national institutions are reformatted. It’s a very sad story. Apparently, humanity will have to live through hard times again and to suffer a lot to realize the preciousness of the world that we once had. The pace of development of modern technologies and the linear development of human mentality are in dramatic conflict. Everything has to be restored to balance. All the rest is a consequence of this main conflict.”

As the 2019 year came to a close, the dollar syndicate was clearly under pressure. Every investment advisor or investment analyst I spoke to shared the opinion that the very central bank and financial engineering steroids that had helped the US equity markets outperform equity markets in Europe, Asia and the emerging markets since the financial crisis had reached their limits and it was time to rebalance into economies that had more attractive growth rates and lower price/earning ratios. Moreover, there was a good chance that US dollar index would fall as the spiral up in debt and deficits, the gimmickry in federal accounting and intense political tensions in the United States signaled growing economic and political weakness.

Very few expected that the health care establishment could come to the rescue of the central bankers to engineer a shock-doctrine deflation designed to provide the justification for a new round of rich financial bailouts and accelerate adoption of an new digital transaction system. It was – yet again – another miraculous save for the dollar syndicate and system. By spring 2020, the US dollar was up 4% for the year and the long Treasury ETF had returned 31% for the prior 12 month period.

Before I dive into current events, I want to spend some time on several areas that are critical to understanding our existing currencies and financing and where we are headed.

1 See FASAB Statement 56: Understanding New Government Financial Accounting Loopholes (https://constitution.solari.com/fasab-statement-56-understanding-new-government-financial-accounting-loopholes/) and Caveat Emptor: Why Investors Need to Do Due Diligence on U.S. Treasury and Related Securities (https://home.solari.com/caveat-emptor-why-investors-need-to-do-due-diligence-on-u-s-treasury-and-related-securities/).

2 From Pew Research, February 2019: “Mobile technology has spread rapidly around the globe. Today, it is estimated that more than 5 billion people have mobile devices, and over half of these connections are smartphones. But the growth in mobile technology to date has not been equal, either across nations or within them. People in advanced economies are more likely to have mobile phones – smartphones in particular – and are more likely to use the internet and social media than people in emerging economies. For example, a median of 76% across 18 advanced economies surveyed have smartphones, compared with a median of only 45% in emerging economies.” https://www.pewresearch.org/global/2019/02/05/smartphone-ownership-is-growing-rapidly-around-the-world-but-not-always-equally/

3 If you have not read or watched The Red Button Story, you can find it at https://home.solari.com/the-red-button-story/.

4 https://home.solari.com/sir-james-goldsmiths-1994-warning/.

5 For an excellent example of the intensity of the effort to achieve private control of central banks see the documentary Princes of Yen http://princesoftheyen.com

6 https://en.wikipedia.org/wiki/Stephen_Friedman_(PFIAB).

7 https://en.wikipedia.org/wiki/Iraq_War.

8 [Book review on Financial Sanctions]

9 You can find excellent examples in the story of Hamilton Securities, found in Dillon Read & Co. Inc. & the Aristocracy of Stock Profits (https://dillonreadandco.com/), the story of Abacus Savings Bank (https://www.abacusmovie.com/), our Solari Report interview with Howard Root (author of Cardiac Arrest), the Solari Report interview with Helen Chaitman (author of JPMadoff) regarding JPMorgan’s leadership in the Madoff Ponzi scheme, my interview with attorney Carolyn Betts on legal tactics in our series on Deep State Tactics 101 (Part V), and my book review of The American Trap by Frédéric Pierucci, with Matthieu Aron.